30A Property Values: 20-Year Trends

After two decades of boom, bust and rebound, 30A property values remain strong despite recent cooling, driven by land scarcity, tourism and luxury demand.

The 30A real estate market in South Walton, Florida, has seen dramatic shifts over the past 20 years, shaped by changing buyer profiles, limited land availability, and evolving economic conditions. Here’s a quick overview of the key trends:

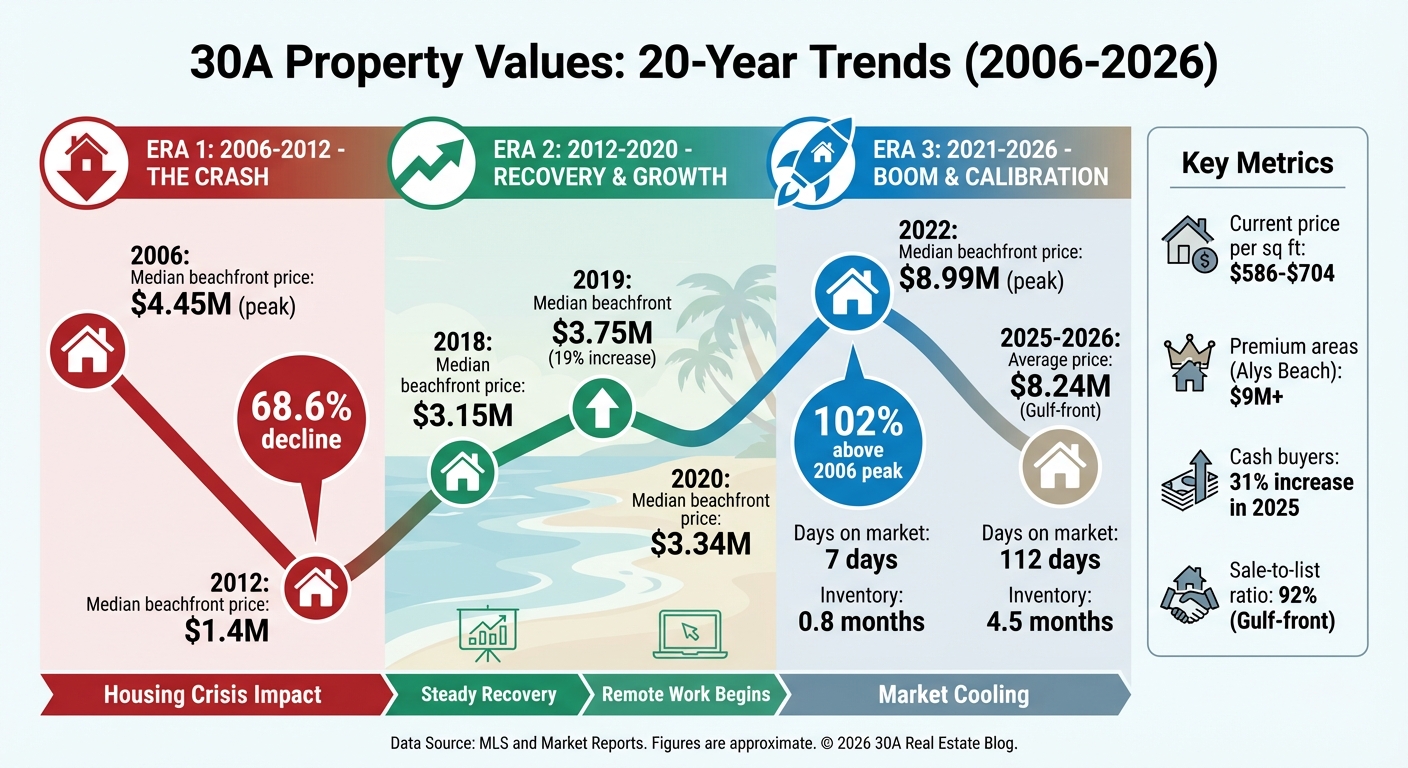

- 2006-2012: The housing crisis caused beachfront property prices to drop from $4.45M to $1.4M, a 68.6% decline.

- 2012-2020: Recovery and growth followed, with median prices reaching $3.15M by 2018. Remote work and cash buyers drove demand.

- 2021-2026: The pandemic triggered a boom, pushing prices to $8.99M in 2022. By 2025, rising interest rates and increased inventory slowed the market.

Today, 30A remains a sought-after destination, with premium areas like Alys Beach commanding $9M+ prices. While the market has cooled, long-term value is supported by land scarcity, tourism, and high-end development. Buyers now have more negotiating power, but demand for luxury and lifestyle-driven properties continues to shape this market.

30A Property Values: 20-Year Price Trends 2006-2026

2006-2015: Recovery and Growth

How the 2008 Housing Crisis Affected 30A Properties

The 2008 housing crisis hit the 30A market hard. In 2006, beachfront homes reached a median price of $4,455,000, but by 2012, those prices had plummeted 68.6% to $1,400,000. Adjusted for inflation, that low was around $1,815,000 - a staggering drop not seen in decades. Between 2006 and 2012, uncertainty loomed over the market, leaving many investors and homeowners unsure of what lay ahead.

The downturn was amplified by a market heavily influenced by flippers and highly leveraged investors, primarily from North Florida, Georgia, and Alabama. However, starting in 2012, the tide began to turn. Buyers shifted their focus from quick profits to long-term investments, viewing 30A properties as lifestyle assets rather than speculative opportunities. This change in mindset, coupled with steady price increases through 2015, signaled a slow but steady recovery.

Tourism and Infrastructure Development

30A's unique appeal played a crucial role in stabilizing the market. As Kavin Kuykendall of Spears Group explained:

"Scarcity of land, strong tourism, high quality development, and a loyal repeat buyer base"

While other markets struggled to recover, 30A's limited inventory and reputation as a sought-after vacation spot helped maintain a baseline for property values. Enhancements in local infrastructure - such as the addition of boutique shops and restaurants in areas like Seaside and Rosemary Beach - further boosted the region's appeal. These developments attracted buyers who were more interested in the lifestyle benefits of owning property in 30A than in short-term gains.

2016-2020: Real Estate Boom

The period from 2016 to 2020 saw the 30A real estate market enter a phase of rapid growth, building on the recovery of prior years.

Rising Demand and Limited Housing Supply

From 2012 to 2018, the 30A market found its footing, but 2019 marked a dramatic shift. That year, median sales prices for beachfront properties climbed 19%, jumping from $3,150,000 in 2018 to $3,750,000 in 2019. What fueled this surge? A growing and increasingly diverse pool of buyers. The market, once dominated by regional investors from North Florida, Georgia, and Alabama, began attracting buyers from across the eastern U.S. and even from the West Coast.

As in earlier years, limited housing supply and changing buyer demographics played key roles in shaping the market. By 2020, even amid the uncertainty of the pandemic, the median beachfront price remained strong at $3,337,500. This resilience highlighted the enduring appeal of 30A as a destination for lifestyle-driven investments.

Changes in Buyer Demographics

The typical 30A buyer underwent a noticeable transformation during this time. The speculative, highly-leveraged flippers of the 2005 bubble gave way to cash buyers who intended to occupy or frequently use their properties. Jacob Angelo and Paul LaCourse of Anchor Real Estate captured this shift:

"Since 2019, driven by the new trends of remote work and immigration from other states, the pool of buyers has become wider and stronger... These buyers favor cash purchases. They also are end-users".

The rise of remote work played a pivotal role, allowing professionals to relocate to coastal areas like 30A without compromising their careers. This shift expanded the market significantly. At the same time, institutional investors like BlackRock began to take notice, injecting substantial capital into the region. Angelo and LaCourse further explained:

"The attention given since 2019 to NW Florida by large investment funds, such as BlackRock, has compounded the demand and improved the buyers' solvency".

These evolving buyer dynamics not only strengthened the market but also laid the groundwork for future fluctuations and new investment strategies.

2021-2026: Market Volatility

Pandemic Boom and Post-Pandemic Cooling

Between 2021 and 2026, the 30A real estate market experienced notable ups and downs. The pandemic era brought a surge in activity, largely fueled by remote work, migration from high-cost states, and historically low interest rates below 3%. Homes were flying off the market in 2022, often selling within just 7 days. Buyers were so eager that many skipped inspections and placed multiple offers well above the asking price.

By 2025, however, the market began to settle. Rising interest rates and an increase in available inventory - jumping from a tight 0.8 months in 2022 to 4.5 months by late 2025 - slowed the pace of sales. The average time to contract stretched from 7 days to about 50 days. Buyers became more cautious, frequently negotiating for repairs and requesting closing cost concessions. As Ryan Zachos of Zachos Realty & Design Group put it:

"The Florida market didn't crash - it calibrated. For anyone considering relocating... understanding these market dynamics is crucial for making smart, data-driven decisions rather than emotional ones."

Cash purchases saw a 31% jump in 2025, and builders adapted by offering mortgage rate buydowns of 1–2 percentage points and covering closing costs in the range of $10,000 to $30,000 to remain competitive with resale properties. These adjustments signaled a shift toward more balanced market conditions and price corrections.

Median Sale Prices and Market Conditions

The market's recalibration was evident in pricing trends. In Santa Rosa Beach, the median sale price peaked at $1,130,833 in December 2025. However, by January 2026, the average home value had dropped to $848,079 - a 6.9% decline over the course of a year. Homes stayed on the market longer, with a median of 112 days, and 91.8% of sales closed below the list price.

Despite the broader slowdown, premium areas held their ground. Alys Beach saw an average sale price of $9.04 million in Q4 2025, with properties selling at $2,111 per square foot. Gulf-front homes along 30A averaged around $8.24 million during the same period. Meanwhile, more affordable options became available, such as WaterSound Origins, where the average sale price was approximately $1.27 million.

20-Year Trends: A Comparative Analysis

Looking back over two decades, the evolution of 30A property values tells a story of dramatic highs, challenging lows, and remarkable rebounds.

Median Sale Prices and Price per Square Foot

The last 20 years have brought sweeping changes to the 30A real estate market. Beachfront properties, once peaking at $4.45 million in 2006, saw a sharp decline to around $1.4 million by 2012 - a staggering drop of nearly 69%. Recovery was slow but steady, with median prices climbing back to approximately $3.15 million by 2018.

Then came the pandemic, which redefined the market. By 2022, beachfront median prices had skyrocketed to $8.99 million, marking a 102% jump from the 2006 peak in raw dollar terms. However, when adjusted for inflation, the 2005 peak was still 24.2% higher than the 2021 market level.

As of February 2026, Santa Rosa Beach listings averaged $704 per square foot, while sold properties settled at $586 per square foot. Gulf-front properties, as expected, fetched much higher prices, reflecting their exclusive appeal.

| Period | Median Sale Price (Raw) | Price Per Sq Ft | Market Phase |

|---|---|---|---|

| 2006–2015 | $4.45M (2006) → ~$1.4M (2012) | - | Bubble, Crash & Early Recovery |

| 2016–2020 | ~$3.15M by 2018 | - | Steady Growth |

| 2021–2026 | $8.99M (2022) → ~$8.24M (2026) | $2,111–$2,436 (Gulf-front) | Pandemic Boom & Cooling |

These numbers provide a lens into the market's evolution and set the stage for understanding shifts in buyer behavior and inventory trends.

Days on Market and Inventory Changes

Beyond pricing, the pace of sales and inventory levels reveal how buyer dynamics have shifted over time. During the frenzied market of 2022, properties averaged just 40 days on the market. By early 2026, this had stretched to 123 days in Santa Rosa Beach, signaling a move from urgency-driven purchases to more deliberate decision-making.

Between 2012 and 2018, limited inventory fueled intense bidding wars. By Q4 2025, detached homes averaged 97 days on the market, while condominiums took about 124 days. Gulf-front properties saw a 92% sale-to-list ratio, indicating sellers needed to adopt more competitive pricing strategies. Amin Delawalla of the Delawalla Group summed it up perfectly:

"2025 was defined by normalization and opportunity: sellers needed sharper pricing and stronger marketing, while buyers gained more choices and negotiating room".

Future Outlook for Buyers and Investors

The 30A market has undergone a significant transformation, moving away from the speculative environment seen before 2008. Today, it is largely driven by cash buyers, end-users, and institutional investors. Limited land availability and stricter hurricane-resistant construction standards have created a stable foundation for property values, helping to maintain price consistency over time.

Long-Term Growth Rate Analysis

From 2002 to 2022, the median price for 30A-West beachfront homes rose sharply, climbing from $1.9 million to $8.99 million in raw terms. When adjusted for inflation, these values increased from $3.14 million to $9.64 million, showcasing true market growth. This upward trajectory reflects not only stronger demand from end-users but also improvements in construction quality and investments backed by solid, non-leveraged capital.

The market now operates within a two-tier system. Newly constructed, high-spec luxury homes fetch premium prices, while older properties that lack modern updates often linger on the market longer and face steeper price negotiations. Kavin Kuykendall of Spears Group highlighted this dynamic, stating:

"30A remains one of the most desirable and stable coastal markets in the country. Scarcity of land, strong tourism, high quality development, and a loyal repeat buyer base together reinforce property values year after year."

This long-term stability provides a foundation for analyzing the market's near-term outlook.

2026-2030 Market Outlook

The trends of the past two decades continue to influence the market, but new demographic shifts are also shaping its future. The rise of remote work has drawn buyers from regions like the Midwest, Texas, and the Northeast, many of whom are looking for homes that combine resort-style living with functional workspaces. Unlike the short-term flipping strategies of the past, today’s buyers are focused on well-designed properties that cater to lifestyle needs and long-term family use.

For those investing in rental properties, timing is key. Acquiring properties between January and April can help investors get ahead of the spring buying surge. However, current conditions require significant upfront investment - typically 30–40% down - to break even on vacation rentals. While the market has cooled from the frenzied activity of 2022, buyers now have more negotiating power. Despite this, the enduring factors of land scarcity and strong tourism continue to bolster long-term property values.

FAQs

What’s driving 30A prices long-term despite market cooling?

Long-term property prices along 30A are influenced by three key factors: high demand, scarce land availability, and consistent rental income potential. These elements help maintain property values, even during periods when the market shows signs of slowing down.

Is now a better time to buy on 30A than during the 2022 boom?

The market has leveled out, with home prices dropping 14.1% from 2024, more inventory available, and strong rental demand. These shifts make now a more favorable time to buy on 30A compared to the heated market of 2022.

Which 30A areas are holding value best in 2025–2026?

In 2025–2026, areas like Seagrove and Seacrest are holding their property values well. This stability is driven by consistent pricing, a rise in available properties, and strong demand for rentals. Meanwhile, Alys Beach continues to stand out as a sought-after and exclusive community, showcasing its lasting allure and premium status.