Checklist for Registering Your Car in Walton County

Step-by-step checklist for vehicle registration in Walton County: required documents, fees, VIN inspection, Florida insurance and 10-day deadlines to avoid penalties.

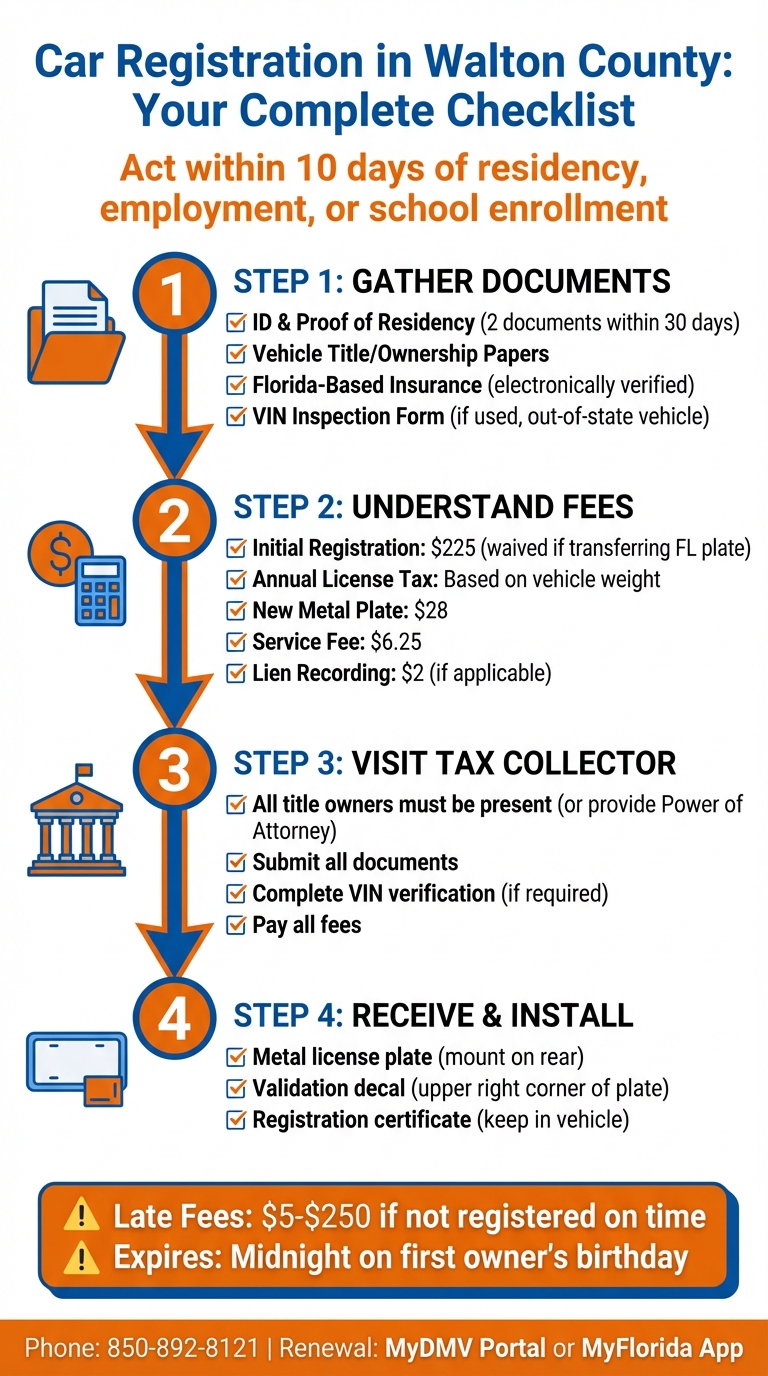

To register your car in Walton County, Florida, you'll need to act quickly - state law requires registration within 10 days of establishing residency, starting a job, or enrolling kids in school. Here's a quick breakdown of what you need to know:

- Required Documents: Bring proof of ID, residency (two recent documents like utility bills or a lease), your vehicle's title or ownership papers, and Florida-specific insurance.

- Fees: Expect an initial registration fee of $225 (if you don't have a Florida plate to transfer), annual license taxes based on vehicle weight, and additional charges for plates, titles, or liens.

- VIN Inspection: Required for used vehicles from out of state. This can be done at the Tax Collector's office or by a Florida notary or law enforcement officer.

- Insurance: Only Florida-based insurance policies are accepted and must be electronically verified.

- Deadlines: Avoid late fees by registering on time; penalties range from $5 to $250.

Once registered, you'll receive a license plate, a validation decal, and a registration certificate. Keep the certificate in your car at all times. Act quickly to avoid fines and ensure you're driving legally in Florida.

Step-by-Step Guide to Registering Your Car in Walton County Florida

Registering Your Car in Florida | What You Need to Know

Required Documents

Getting all your documents together ahead of time can make your trip to the Tax Collector's office much smoother. You'll need to prepare items in three main categories: identification and proof of residency, vehicle ownership papers, and Florida insurance verification.

ID and Proof of Residency

Bring a valid U.S. driver's license, ID card, or passport for every person listed on the vehicle title. If any of the owners can't attend in person, they must complete a Power of Attorney form.

You'll also need two documents proving your residential address in your name. These can include:

- A deed, mortgage statement, or lease agreement

- Utility bills (electric, water, cable, or gas)

- Bank or credit card statements

- Voter registration card

- W-2 or paycheck stub

- Insurance policies or medical bills

All documents must be dated within the last 30 days. If you can't provide two proofs in your name, you can use HSMV Form 71120 (Certification of Address). In this case, the person certifying your address must provide their own proofs of residency and either appear with you or have the form notarized. If needed, your auto insurance policy (dated within 30 days) can count as one of your proofs.

Once you've handled your ID and residency documents, move on to your vehicle ownership paperwork.

Vehicle Ownership Papers

You'll need the original out-of-state title for the vehicle. If you purchased the vehicle within the last six months, include the bill of sale. For new vehicles, bring the manufacturer's certificate of origin instead of a title.

If there's a lien on the vehicle, provide the VIN, the lienholder's name, and their fax number. The Tax Collector's office will reach out to the lienholder to request the title, which can take up to four weeks. Starting this process early is a good idea.

For vehicles previously titled out of state, a physical VIN inspection is required. Use Form 82042 for this step. You can complete the inspection at the Tax Collector's office during your visit, or beforehand with a Florida notary or law enforcement officer. However, VIN verification isn't needed for new motor vehicles, mobile homes, or trailers under 2,000 pounds.

With ownership verified, the final step is ensuring your insurance meets Florida's requirements.

Florida Insurance Verification

You must provide proof of Florida-based insurance, such as a binder, policy, or member card issued or countersigned by a licensed Florida agent. Out-of-state policies won't be accepted.

"Only insurance issued or countersigned by a Florida agent is electronically reported to the Department of Highway Safety and Motor Vehicles for verification purposes." - Walton County Tax Collector

Check with your agent to confirm that your policy has been reported to the DHSMV system. This electronic verification is a critical step in processing your registration. If you cancel your Florida insurance later, remember to surrender your license plate to avoid having your driver's license suspended.

Registration Fees and Taxes

Once your documentation is ready, it's time to understand the fees and taxes involved in vehicle registration. Here's a breakdown of what to expect in Walton County, which follows Florida's fee structure.

Initial Registration Fee

If you're registering a motor vehicle in Florida for the first time, there's a one-time $225.00 initial registration fee. This applies to private-use cars, motor homes, and trucks under 5,000 pounds.

However, you can avoid this fee by transferring an existing Florida license plate. If you've recently sold or traded in a vehicle already registered in Florida, bring the necessary documents to take advantage of this cost-saving option.

Annual License Tax

Florida's annual license taxes are based on your vehicle's weight and whether you choose a one-year or two-year registration period. These taxes are due at the initial registration and each renewal.

For most privately owned vehicles, registration expires at midnight on the first owner's birthday. Renewing for two years can help you lock in current rates and avoid yearly visits to the tax office. For example:

- A car weighing 2,500–3,499 pounds costs $36.10 for one year or $72.20 for two years.

- A truck weighing 6,000–7,999 pounds costs $99.85 for one year or $199.70 for two years.

Leased or "For Hire" vehicles follow a different structure, typically involving a flat fee plus a rate per 100 pounds (cwt) of vehicle weight.

Other Fees

Here are some additional charges to consider:

- New metal license plate: $28.00. Plates are replaced every 10 years in Florida.

- Service fee: $6.25 for credentials issued at the tax collector's office.

- Lien recording fee: $2.00 if your vehicle has a loan.

- Paper title fee: $2.50 for a paper title instead of an electronic one.

- Specialty license plates: Annual use fees range from $15.00 to $30.00, plus a $5.00 processing fee.

Late renewals come with penalties starting on the 11th calendar day after your registration expires. These fees range from $5.00 to $250.00, depending on your base license tax amount. Renewing on time can help you avoid these extra costs.

Understanding these fees will help you budget effectively as you move through the registration process.

How to Register Your Vehicle

Getting your vehicle registered in Walton County doesn’t have to be complicated. By following the steps below and having the necessary documents ready, you can make the process straightforward.

Visit the Tax Collector's Office

Make sure all individuals listed on the title are present. If someone can't attend, bring a completed Power of Attorney form to act on their behalf. Have all required documents with you as outlined earlier.

For vehicles with a lien, you'll need to provide the VIN, the lienholder’s name, and their fax number. The Tax Collector's office will handle the title request from your lienholder, which usually takes around four weeks. If you're dealing with more complex situations, such as trusts, businesses, or transferring ownership from a deceased person, contact 850‑892‑8121 for specific instructions on the additional paperwork you’ll need.

After submitting your documents, you may need to complete a VIN verification, depending on your vehicle’s qualifications.

VIN Verification (When Required)

If your vehicle is coming from out of state, a VIN inspection is required. This applies to used motor vehicles like cars, trucks, motorcycles, and motor homes, as well as trailers that weigh 2,000 pounds or more. However, VIN verification isn’t necessary for new vehicles that have never been titled, mobile homes, travel trailers, or smaller trailers under 2,000 pounds.

For out-of-state used vehicles and heavier trailers, you can get a VIN inspection done at the Tax Collector's office if the vehicle is drivable. Alternatively, you can have the inspection completed beforehand by a Florida notary or law enforcement officer using form 82042 .

Final Registration Steps

Once your documents are approved and fees are paid, you’ll receive three items: a metal license plate, a registration certificate, and a validation decal. The license plate must be mounted on the rear of your vehicle, and the decal should go in the upper right-hand corner of the plate. Always keep your registration certificate - or an official copy - in your vehicle to show law enforcement if needed. Before leaving the office, double-check that all the numbers on your documents match .

License Plate Renewal Methods

Renewal by Mail, Phone, or Online

Once your vehicle is initially registered, you can renew your license plate through several convenient methods: online, by phone, or through the mail.

If you prefer online renewals, head to the MyDMV Portal, where you can choose between one-year or two-year renewal options. Keep in mind, there’s a $2.00 processing fee for electronic payments. Once completed, your new decal will arrive within 7–10 business days. Alternatively, the MyFlorida app - available on iOS and Google Play - lets you renew up to five vehicles in one transaction. Processing fees for the app are $4.00 for credit card payments or $3.75 for checking accounts.

For phone renewals, call 850-892-8121 and provide either your tag number or your Driver’s License number. If you opt for mail renewals, use the renewal packet provided. Regardless of the method you choose, you can renew your registration up to three months before it expires. Late fees only apply after the 11th day of the month following your plate’s expiration.

Before renewing, ensure there are no holds on your account for toll violations, child support issues, or insurance suspensions. If renewing online, your Florida insurance coverage must be electronically verified, so have proof of insurance handy. Note that address updates cannot be made through the mobile app; instead, use the MyDMV Portal or visit a local office.

License Plate Replacement Schedule

In addition to renewing your registration, it’s important to know about Florida’s license plate replacement policy. Florida metal license plates are issued with a ten-year lifespan. Once your plate reaches its tenth year, it must be replaced. This replacement is automatically included in your renewal process, so you’ll receive a new plate along with your updated registration.

Final Checklist and Tips

Before heading to the Tax Collector's office, make sure all title owners are either present or have provided a Power of Attorney form. Also, check that no co-owner has a suspended license, as Florida law prohibits registration in such cases.

Your insurance must be issued by a Florida-licensed agent. If you're bringing a used vehicle from another state, you'll need to take it to the Tax Collector's office for an on-site VIN verification. Additionally, confirm any requirements from your lienholder.

If a lienholder holds the title, you'll need to provide your VIN and the lienholder's contact information. The Tax Collector will request the title on your behalf, but this process typically takes about 4 weeks. Keep in mind, a $225 initial registration fee applies if you don’t have a previous Florida registration to transfer.

Once registered, place the validation decal on the upper right corner of your license plate. Keep the registration certificate with you or in the vehicle, as Florida law requires. Also, note that your registration will expire at midnight on the first owner's birthday - not at the end of the month.

FAQs

What counts as establishing residency for the 10-day rule?

To establish residency in Florida under the 10-day rule, you’ll need to take specific actions that demonstrate your move to the state. This typically involves getting a Florida driver’s license and registering your vehicle within 10 days of becoming a resident. These steps not only solidify your residency status but also ensure you’re meeting Florida’s legal requirements.

Can I register my car if the lienholder has the title?

Yes, you can register your car in Walton County even if the title is held by a lienholder. Florida offers a "Registration Only" option for vehicles with an out-of-state title that’s held by a lienholder or leasing company. However, before you can register, you’ll need to complete the VIN verification form. If you want to obtain the title in the future, the lien must be satisfied and removed first.

What if my Florida insurance doesn’t verify electronically?

If your Florida insurance cannot be verified electronically, you can still register your vehicle by presenting physical proof of insurance. This can include a binder, policy, or insurance card issued by a certified Florida agent. Simply bring one of these documents to the DMV office. It's a good idea to reach out to your local Walton County DMV or Tax Collector’s Office ahead of time to confirm their specific requirements or learn about any alternative verification methods.