How to Navigate the 30A Housing Market as a First-Time Buyer

Practical guide for first-time buyers on 30A: market trends, neighborhood choices, mortgage prep, offer strategies, inspections and closing tips for 2026.

The 30A housing market offers a mix of opportunities and challenges for first-time buyers in 2026. Stretching along Florida's Gulf Coast, this area is known for its scenic neighborhoods and consistent property value growth. However, limited inventory, high demand, and competitive pricing make preparation essential. Here's what you need to know:

- Market Overview: Entry-level homes start at $400,000, while condos range from $500,000 to $1.2 million. The median sold price in 30A East is $1.44 million, with room for negotiation as the sale-to-list ratio is around 90%.

- Mortgage Rates: Rates have dropped to 6.32%, making it a favorable time to buy.

- Neighborhoods: Options vary from budget-friendly areas like Point Washington to upscale communities such as Rosemary Beach. Seaside and Seagrove Beach are ideal for walkability and rental income potential.

- Preparation: Get pre-approved for a mortgage, create a detailed budget, and account for taxes, insurance, and HOA fees and community rules. Avoid major financial changes during the buying process.

- Home Search: Use tools to track listings, focus on properties with price reductions, and evaluate rental income potential if investing.

The key to success lies in understanding the market, preparing your finances, and working with a knowledgeable local agent. Early 2026 could be a great time to secure a property before competition rises again.

How to Win in Today's 30A Real Estate Market! | Q2 2025 Market Report

What's Happening in the 30A Housing Market Right Now

As we step into 2026, the 30A housing market appears more steady compared to the rollercoaster years of 2022 through 2024. With mortgage rates easing and inventory levels balancing out, the market presents both opportunities and hurdles for first-time buyers. Let’s dive into the details shaping these trends.

Low Inventory and High Demand

Even though inventory has seen a slight increase since the pandemic, desirable homes are still selling at a rapid pace. In the 30A East area, the market reported 8.7 months of inventory by late 2025 - a figure that typically indicates a buyer's market. But numbers can be misleading. Well-priced homes in sought-after, walkable neighborhoods like Seaside and Rosemary Beach continue to spark bidding wars.

First-time buyers face tough competition. Many are outmatched by homeowners with significant equity, who can offer stronger bids. Dr. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors, highlights this challenge:

"First-time buyers are still struggling, while equity-flush homeowners are able to make housing trades".

On a national level, first-time buyers represent just 21% of home purchases. This limited presence underscores how difficult it is for new buyers to compete against seasoned homeowners with more financial leverage.

On the financing side, there’s some good news. Mortgage rates have become more favorable, dropping to about 6.32% as of January 22, 2026, down from nearly 6.8% in mid-2025. This slight dip has had a big impact. Dr. Brad O'Connor, Chief Economist at Florida Realtors, explains:

"That small decline [in rates] was enough to unlock a good amount of pent-up housing demand".

With rates projected to hover around 6% for much of 2026, buyers are entering the market faster, snapping up available homes. For those ready to act, early 2026 could be a prime time to make a move.

Home Prices and Market Data

The current market trends are also influencing home prices and the deals available to buyers. In the 30A East area, the median sold price stood at $1.44 million as of October 2025 - a drop of 27.9% from the previous year. Homes averaged $860 per square foot, with properties spending about 106 days on the market. Perhaps most encouraging for buyers is the sale-to-list price ratio of roughly 90%, signaling room for negotiation on homes that sit on the market longer than average.

While entry-level options are limited, they’re not completely out of reach. For example, condos in Seacrest are starting at $525,000, while four-bedroom townhomes in Inlet Beach are listed around $975,000. Candice KausHagen, a 30A Lifestyle Agent, captures the current sentiment:

"Mortgage rates fell quite a bit this week to the lowest levels in a year. Coupled with a buyer's market… now is an opportune time to buy in 30A".

That said, if rates drop further, the pendulum could quickly swing back in favor of sellers, tightening competition once again.

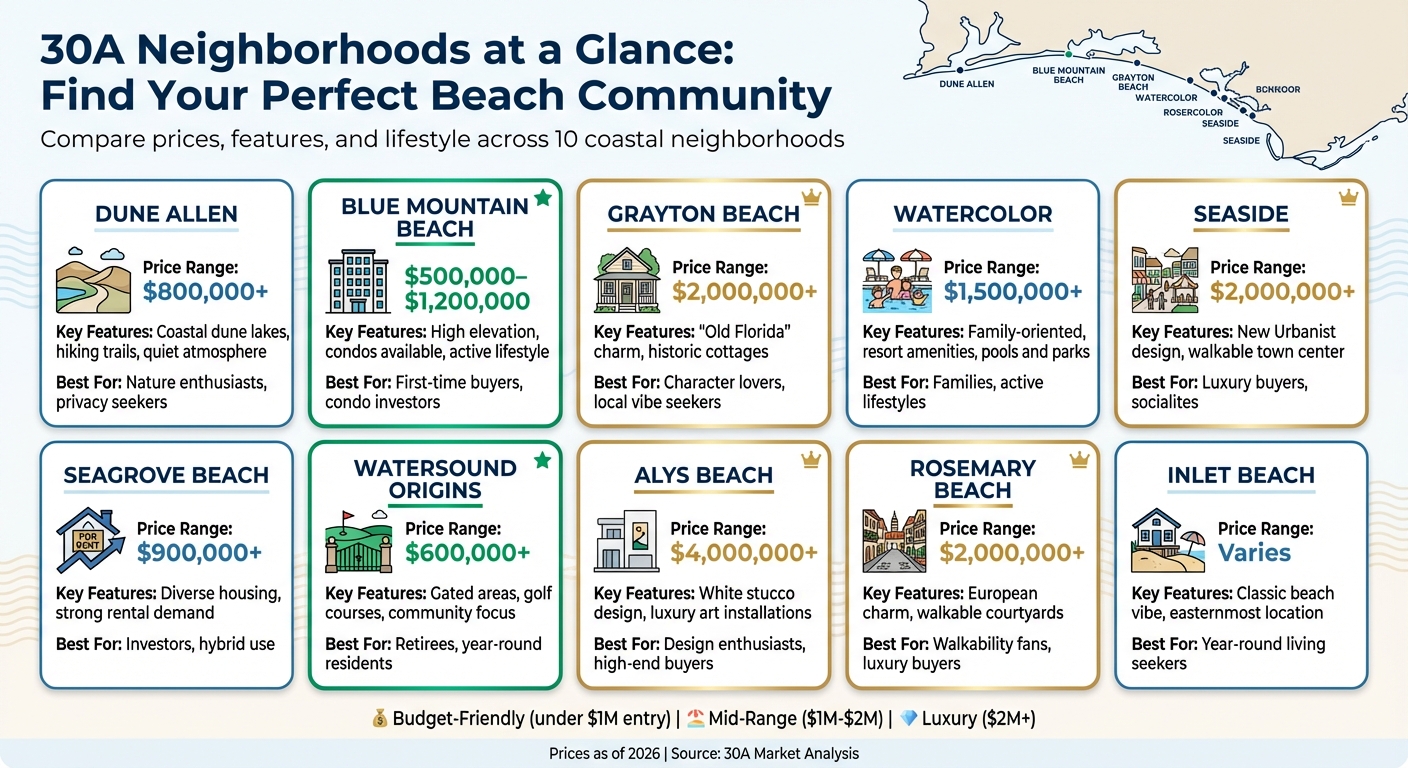

Choosing the Right 30A Neighborhood

30A Neighborhoods Comparison: Prices, Features and Best Buyers Guide

Picking the perfect neighborhood along 30A comes down to your priorities - whether that's being able to walk everywhere, maximizing rental income, or immersing yourself in nature. South Walton is home to 16 beach neighborhoods, each with its own personality and price range. From budget-friendly areas for first-time buyers to upscale havens for luxury seekers, there's something for everyone.

For first-time buyers on a budget, neighborhoods like Point Washington and Santa Rosa Ridge offer a more affordable way to enjoy the 30A lifestyle. Homes here typically range from $400,000 to $800,000, and many still allow golf cart access to the beach. Condos are another budget-conscious option, often providing the added perk of HOA-managed maintenance.

If rental income potential is your focus, Seagrove Beach and Seacrest are excellent choices with a strong mix of housing options and steady demand. Blue Mountain Beach also stands out for investors, offering lower entry prices while still delivering solid returns.

For those who value walkability and community, Seaside and Rosemary Beach are hard to beat. Seaside is famous for its 30A architecture, featuring pastel-colored homes, cobblestone streets, and white picket fences that embody the principles of New Urbanism [18, 19]. Rosemary Beach brings a European flair with its winding pathways and charming courtyards. On the other hand, if privacy and nature are what you crave, Dune Allen and Grayton Beach might be more your speed. Dune Allen is known for its rare coastal dune lakes and hiking trails [18, 19], while Grayton Beach offers a laid-back vibe with "Old Florida" cottages and a tight-knit community feel [18, 19]. WaterColor provides a blend of luxury and family-friendly amenities, making it a great option for those seeking a resort-like atmosphere with a small-town charm [18, 19].

Here’s a closer look at some of the standout neighborhoods to help you decide.

Neighborhood Overviews

Dune Allen, located at 30A’s western end, is a nature lover’s dream with three rare coastal dune lakes ideal for paddling or kayaking. Homes here typically start around $800,000 [2, 18, 19].

Blue Mountain Beach boasts the highest elevation along 30A and is named after its vibrant blue lupine flowers. Condos start at approximately $500,000, making it a more attainable option for first-time buyers or investors [2, 18, 19].

Grayton Beach, the oldest community on 30A, charms visitors with its "Old Florida" cottages and relaxed atmosphere. Homes with beach access usually start at $2 million or more [2, 18, 19].

WaterColor is a master-planned community that’s especially popular with families. With amenities like Camp WaterColor, community pools, and parks, homes here start at around $1.5 million [2, 21].

Seaside is the poster child of 30A, thanks to its iconic New Urbanist design and lively town center. Cottages in this walkable community typically start at $2 million [2, 18, 19].

Seagrove Beach offers one of the most diverse housing markets on 30A, from historic cottages to modern new builds. Entry-level homes start around $900,000, making it a favorite for investors.

WaterSound Origins is a smaller, walkable community known for its scenic streets and proximity to a state park. Home prices range from $639,900 for a cozy cottage to $1.7 million for larger properties [18, 23].

Alys Beach is instantly recognizable for its white stucco architecture and high-end art installations. Homes here start at $4 million. Notably, single-family home sales in Alys Beach surged by 111% in Q1 2024, reaching $38,737,399.

Rosemary Beach offers a European-inspired aesthetic, complete with cobblestone streets and fountain-filled courtyards. Homes here usually start at $2 million [2, 18, 19].

Inlet Beach, located at the eastern edge of 30A, retains a classic, untouched beach vibe. It’s becoming increasingly popular with those looking for year-round living options [18, 19, 21].

Neighborhood Comparison Table

Here’s a quick breakdown of what each neighborhood offers:

| Neighborhood | Typical Price Range | Key Features | Best For |

|---|---|---|---|

| Dune Allen | $800,000+ | Coastal dune lakes, hiking trails, quiet | Nature enthusiasts, privacy seekers |

| Blue Mountain Beach | $500,000–$1,200,000 | High elevation, condos, active lifestyle | First-time buyers, condo investors |

| Grayton Beach | $2,000,000+ | "Old Florida" charm, historic cottages | Fans of character, local vibe |

| WaterColor | $1,500,000+ | Family-oriented, resort amenities | Families, active lifestyles |

| Seaside | $2,000,000+ | New Urbanist design, walkable town center | Luxury buyers, socialites |

| Seagrove Beach | $900,000+ | Diverse housing, rental demand | Investors, hybrid use |

| WaterSound Origins | $600,000+ | Gated areas, golf courses, community focus | Retirees, year-round residents |

| Alys Beach | $4,000,000+ | White stucco design, luxury art installations | Design enthusiasts, high-end buyers |

| Rosemary Beach | $2,000,000+ | European charm, walkable courtyards | Walkability fans, luxury buyers |

| Inlet Beach | Varies | Classic beach vibe, easternmost location | Year-round living seekers |

Getting Your Finances Ready

Before you start touring homes, it’s important to have a clear understanding of what you can afford. In a competitive market like 30A, being unprepared can mean missing out on the home you want. Two key steps - getting pre-approved for a mortgage and creating a realistic budget - will ensure you’re ready when the right opportunity comes along.

Getting Pre-Approved for a Mortgage

Pre-approval and pre-qualification may sound similar, but they’re not the same. Pre-qualification is a rough estimate based on self-reported information, while pre-approval involves a lender verifying your financial details with a hard credit check. This process results in a letter stating the maximum loan amount you qualify for, which is typically valid for 60 to 90 days.

"In Florida's competitive coastal market, showing up without pre-approval is like showing up to a game without your gear. Sellers want to know you're serious - and a pre-approval letter proves it."

– Local Life Homes

To get pre-approved, consult multiple lenders to compare rates and loan programs (such as conventional, FHA, VA, or USDA loans). You’ll need to provide documents like pay stubs, W-2s (or tax returns if you’re self-employed), bank statements, and identification. Most buyers receive their pre-approval letter within 24 to 72 hours of submitting the necessary paperwork. Once you have this letter, you can make offers immediately, giving you an edge over other buyers.

It’s also crucial to avoid major financial changes between pre-approval and closing. Actions like switching jobs, taking on new debt, or making large withdrawals or deposits can jeopardize your approval status.

Creating a Realistic Budget

Once you’re pre-approved, it’s time to build a detailed budget that accounts for all costs - not just your mortgage payment. Lenders use the term PITI to describe the breakdown of your monthly payment: Principal, Interest, Taxes, and Insurance. In Walton County, property taxes are based on your home’s assessed value and the local millage rate. If the home is your primary residence, you may qualify for Florida’s Homestead Exemption, which can lower your assessed value by up to $50,000. Additionally, the Save Our Homes (SOH) cap limits annual tax increases to 3% or the Consumer Price Index, whichever is lower.

Beyond the monthly payment, prepare for upfront costs like earnest money (submitted with your offer), the down payment, and closing costs. Closing costs typically include attorney fees, title insurance, appraisals, inspections, and recording fees. While a 20% down payment helps you avoid Private Mortgage Insurance (PMI), some conventional loans require as little as 3%, and FHA loans often require just 3.5%.

Don’t forget to budget for other expenses, such as HOA fees if you’re buying in communities like WaterColor or Seaside. You’ll also need homeowners insurance, and possibly flood insurance, if your property is in a FEMA-designated high-risk flood zone. If you plan to use the home as a short-term rental, be aware that tourist development taxes may apply. On the plus side, Walton County offers early property tax discounts: 4% in November, 3% in December, 2% in January, and 1% in February, which can help lower your costs.

Lastly, work with a local agent to identify motivated sellers who may be open to price negotiations or covering repairs. In early 2025, data showed that while areas like Rosemary Beach had a list-to-sell ratio of 97%, 30A West’s ratio was 87%, suggesting more room for negotiation in certain neighborhoods.

How to Find and Evaluate Homes

Once your finances are in order, it's time to dive into your home search. As of January 25, 2026, the 30A area offers 935 active listings, with a median list price of $1,650,000. Homes here average $869.26 per square foot and typically spend around 137 days on the market. These numbers provide a helpful starting point for planning your search.

Take advantage of advanced search tools to narrow down options by community, property type, or recent price reductions[29, 30]. Tools like "Home Finder" can send automated email alerts whenever new properties hit the market. In a competitive area like 30A, being one of the first to know about a new listing can give you a significant edge.

Don't limit yourself to just active listings. Use resources like "Sold Search" or "Sold Gallery" to see what homes in your preferred area have actually sold for. This can provide a clearer picture of market trends. For example, a Miramar Beach property originally listed at $2,200,000 sold for $2,100,000 after 56 days, while a home in Defuniak Springs sold 10% below its $799,800 asking price in 91 days. Comparing list prices with final sale prices can help you fine-tune your negotiation strategy.

Understanding Active vs. Pending Listings

As you analyze listings, it's important to understand the difference between active and pending statuses. Active listings are still available for purchase, while pending listings are under contract and awaiting closure[30, 33]. In Walton County, homes have recently sold for about 96% of their list price, with an average market time of 124 days. If a listing has been active for more than 60–90 days, it might signal that the seller is open to negotiating.

Identifying Good Deals

A great deal on 30A combines prime location, solid property condition, and income potential. To spot opportunities, use filters to highlight homes with price reductions, especially those reduced by at least 10% or within the past week. These price adjustments often indicate sellers who are ready to negotiate.

If you're considering a property for short-term rental income, use search filters like "Short Term Rental Allowed" to identify homes with strong income potential. Pay attention to the type of beach access (private vs. deeded), as this can significantly affect the property's long-term value. Always request actual rental history and occupancy data to assess the property's earning potential. For instance, a Gulf-front condo at Pinnacle Port reportedly brings in between $30,000 and $35,000 annually when self-managed as a rental.

"Determine the actual selling price of homes in your preferred neighborhoods - not just their listing price - to get a better idea of the actual affordability of the location."

– Live Love 30A

Once you've identified promising properties, protect your investment by arranging professional inspections. Coastal homes can hide issues like structural damage, plumbing problems, or mold that aren't immediately visible during showings. Catching these problems early can save you from costly repairs later and ensure you're paying a fair price for the home.

Making an Offer and Closing

Writing a Competitive Offer

When you're ready to make an offer on a 30A property, it's important to think beyond just the price. Your offer should also include terms that could either increase or decrease its overall appeal to the seller. In this highly competitive market, sellers often receive full-price offers - or even higher - so crafting a strong and strategic proposal is essential.

Start by examining recent sale prices in the specific 30A neighborhood you're targeting, whether that's Rosemary Beach, Seaside, or another area along the scenic highway. This research will give you a realistic idea of what to offer. Work closely with your local agent to determine a price that balances competitiveness with your budget. Additionally, you'll need to provide earnest money upfront, which will later be applied toward your down payment or closing costs.

"While much attention is paid to the offering price of a home, a proposal to buy includes both the price and terms." – The Florida Keys Board of REALTORS

Don't forget to include key contingencies in your offer, such as a mortgage contingency to protect you in case your financing doesn't go through. Counter-offers are common, and any changes from the seller will require a quick response. Stay in close contact with your agent to navigate these negotiations efficiently. If you're up against other buyers, your agent can help you craft terms that make your offer stand out - without stretching beyond your financial limits.

Once your offer is accepted, the focus shifts to the closing process, where you'll take the final steps toward owning your new home.

What to Expect During Closing

After your offer is accepted, the closing process begins. One of the first things you'll need to do is schedule professional inspections. Structural, termite, and system inspections are critical to ensure the property is in good condition. It's a good idea to attend the structural inspection so you can ask questions and get a clear understanding of any potential issues. If the inspection uncovers problems, you may be able to negotiate with the seller to address them before closing.

Meanwhile, your lender will arrange for an appraisal to verify the home's value and finalize your mortgage terms. Be prepared for closing costs, which typically include attorney fees, title insurance, appraisal and inspection fees, courier and recording fees, and taxes. At the closing appointment, you'll sign the necessary contracts, pay your down payment and fees, and finally receive your keys.

Before closing, you'll also need to secure homeowners insurance, as lenders require this to be in place. Most often, the cost is bundled into your monthly mortgage payment. With all the paperwork complete, you'll officially become the owner of your new 30A property.

Your Next Steps to Buying a Home in 30A

Buying your first home along the 30A corridor doesn’t have to feel overwhelming. With a little preparation and the right approach, you can make the process much smoother. Start by getting your finances in order. Check your credit report at AnnualCreditReport.com to spot any errors that might impact your loan terms. Since your credit score - ranging from 300 to 850 - affects the interest rates you’ll qualify for, addressing any issues early could save you thousands over the course of your mortgage. This step lays the groundwork for comparing mortgage options.

Next, shop around for mortgage lenders. Talk to three or four lenders to compare rates and explore loan options like Conventional, FHA, VA, or USDA loans. Be sure to get a formal pre-approval, not just a pre-qualification. A pre-approval gives you a clear idea of your budget and makes your offer stand out in a competitive market.

"Choose an experienced home loan lender and a friendly, knowledgeable real estate agent - they are the key to helping you have a smooth home buying experience!" - apcrealestateflorida.com

Take time to research neighborhoods along 30A, such as Rosemary Beach, Seaside, or Blue Mountain Beach. Look beyond listing prices and focus on actual selling prices to get a realistic idea of what fits your budget. Signing up for property alerts on local real estate websites can also help you stay on top of new listings that match your criteria.

Once you’ve got a handle on your finances and the local market, it’s time to bring in expert help. Work with a local REALTOR® who knows the Emerald Coast inside and out. They’ll help you navigate legal details, find off-market opportunities, and craft offers that stand out. If you’re planning to make your 30A home your primary residence, don’t forget to ask about Florida’s Homestead Exemption, which can provide tax savings.

FAQs

What are the most affordable neighborhoods for first-time homebuyers on 30A?

For those venturing into the 30A real estate market for the first time, Dune Allen and Grayton Beach are fantastic places to begin your search. Dune Allen often features homes that are easier on the wallet compared to some of the pricier spots along 30A, making it a solid choice for buyers working with a tighter budget. Meanwhile, Grayton Beach stands out for its relaxed atmosphere and coastal appeal, offering a mix of affordability and a welcoming community vibe.

If you're considering condos or smaller properties, take a look at neighborhoods like Seagrove and Seacrest. While these areas are becoming increasingly sought after, they still present opportunities for budget-conscious buyers to secure a spot along the picturesque 30A coastline.

What can I do to make a strong offer in the 30A housing market?

To craft a compelling offer in the competitive 30A housing market, your first step should be partnering with a seasoned local real estate agent. Their knowledge of the area and expertise in navigating this fast-paced market can be invaluable.

Acting quickly is key. Ensure your finances are in order by securing pre-approval for a mortgage and establishing a clear budget with some flexibility. This preparation positions you to move confidently when the right property comes along.

You can also strengthen your offer by including appealing terms. Consider options like a larger earnest money deposit or a shorter closing period to catch the seller's attention. Staying up-to-date on market trends and making timely decisions can give you the advantage you need to secure your ideal home.

What are the steps to get pre-approved for a mortgage in the 30A area?

To secure a mortgage pre-approval in the 30A area, your first step is to connect with a reliable lender. They’ll help evaluate your financial situation and figure out how much you can comfortably borrow. This process usually requires you to provide information about your income, assets, debts, and credit score. Once reviewed, the lender will issue a pre-approval letter. This document not only signals to sellers that you’re a serious buyer but also helps define your budget.

Before you apply, take a moment to review your credit report. Look for any errors or issues that might affect your chances of approval and address them beforehand. With your pre-approval in hand, you’ll be better positioned to make confident offers in 30A’s competitive housing market.